How I Make Money From Blogging & Food Writing (2020 Edition)

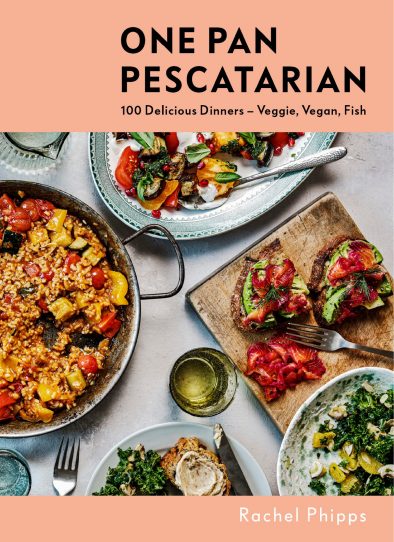

Looking back for a moment, 2020 was one of the weirdest years yet for me running my little blogging and food business. I started the year refreshed from shooting One Pan Pescatarian (ad) just before Christmas and excited for publication later that year. I got stuck into start of year projects, and then the pandemic hit. Most of my freelance work dried up, but more people were visiting my site for recipes stuck at home and getting creative around food shortages, so I was able to finally introduce ads on the site, something I’d been hoping to do for years.

The 2020-2021 tax year was the first year I have used an accountant do to my business accounts, rather than doing them myself, kindly gifted to me by TaxScouts. So, in this post I’m going to run though all the usual parts of my business and how exactly I managed to make money blogging in 2020 (but I have to admit I also didn’t in some cases, so I’ll chat about the government grants I used too) because I know this is such a popular post both to help smaller bloggers with ideas for monetisation, and just for casual readers who are curious, and I’ll review TaxScouts and if I found their service helpful sorting out my Self Assessment this time around.

You can find all my previous ‘How I Make Money Blogging’ posts here: 2013, 2014, 2015, 2016, 2017, 2018, 2019.

Sponsored Posts

Sponsored posts are the bread and butter for most food bloggers, and where most of our income comes from. With budgets on hold and brands holding fire while we were in lockdown, 2020 saw my lowest income from sponsored posts ever recorded (my spreadsheet starts in 2014) with the amount I made less than £500. It was depressing, frightening but very understandable. Happily though I can report that this year already I’ve passed what I made from sponsored posts in 2019.

Website Advertising

After an incredible hike in my website traffic (yes: it was from people looking how to bake banana bread, their own regular bread, and learning how to make a sourdough starter) I finally had enough monthly visitors to join Mediavine, the ad network I’d had my eye on for a while. I had a long hard think about if I wanted to do this and how it would impact you all reading my content, so I have purposely turned off all the types of ads I personally find intrusive when I read other peoples websites. I’ve been so happy to add another revenue stream and it has made all the difference to my business, even if I only saw my first payout in October 2020 as you have to meet a revenue payout threshold and you have to wait 3 months for each batch of revenue to clear.

Affiliate Links

While some websites like fashion and beauty sites can absolutely rake it in using affiliate links, for me this has always been a bit of pocket money in return for clicking a few extra buttons every time I build a new post, though I do hope you find my little ‘You Might Need’ carousels with links to the equipment you need to make each recipe helpful, as well as my Bumper Christmas Gift Guide each November.

I receive affiliate income from both rewardStyle and Amazon Associates, and I’m perfectly happy working with both.

While the landscape in 2021 has now changed in this (but more on that next year!) in 2020 there was still a little money to be had on Instagram with sponsored blog posts, especially during the pandemic searching for brands to work with on apps that creators can sign up to (at the time I used Tribe) who were looking to reach consumers who had nothing better to do than spend all day on their phones. I only made 1/4 of what I had off of Instagram the previous three years, but in the context of 2020, it was better than nothing. I was also approached by brands directly for a few of these too.

Freelance Food Writing & Recipe Development

I consider myself incredibly lucky to be a regular contributor to BBC Food, who, with such a demand for recipes designed for home cooks kept commissioning throughout the pandemic. With only one exception all of my freelance revenue in 2020 came from writing for them, and I was only about £100 shy of having my best freelance year yet.

One Pan Pescatarian

I have mixed feelings about my book coming out during the pandemic. We had to push back the planned publication date which was super stressful, and I’m very sad I missed out on all the in person promotional opportunities that would have come with it, but I was publishing a cookbook literally at the moment everyone was enthused about cooking at home. I have no idea how much all of this has impacted sales (and if it is negative I’m not sure I want to know!) 2020 included the final 1/3 of my cookbook advance (the money you get paid for writing the book that you have to earn back in royalties before you get paid any royalties), the fee I was paid by my publishers to act as the home economist on the cookbook shoot (essentially cooking all the food ready for the photographs) and a small percentage of an earlier part of my advance on account of an accounting error.

Glendon Studios

As some of you may not know, I spend a lot of my time when I’m not cooking and working on recipes running a little one woman social media consultancy focusing almost exclusively on helping food creators live their best lives on Pinterest called Glendon Studios.

Mostly I have regular clients whose Pinterest I run month on month sorting out their pin designs and pinning strategies but I do also have clients I just do pin design work for, and sometimes if I’ve got a bit of time on my hands between projects I take one off batch pin design projects too.

Government SEISS Grants

As discussed, it was a very difficult year for me and my business, as well as us all, and there were times when I thought I’d have to go back to an office job having no idea if I’d be able to support myself full time blogging after the pandemic. Happily I’m still here, diversifying for a changing world, but I know my life would not look like it does now without the government support grants that were offered to the self employed – for a start, I’d probably have had to spend my house deposit so I’d not be sitting at the kitchen table of the first home I’ve owned writing this post!

I’m not saying that the way the grants were distributed were fair, and I’m not saying that I was not insulted when I saw the calculations they’d made which included periods where I was still in a regular job as what they felt the given percentage of my work was worth, but they got me and my finances through, for which I am very grateful.

I only took the first three grants on offer, all in 2020 because by the start of this year things for my business were back to what I’d at least describe as a new normal.

So how does this compare with last year?

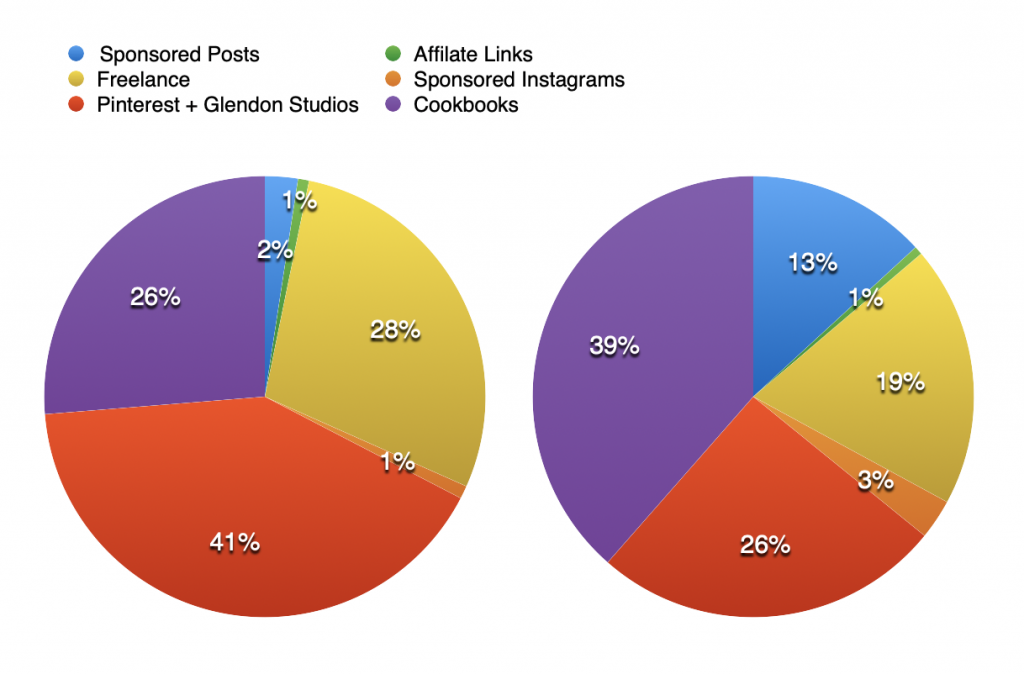

Okay, so with income all over the place it is really difficult to visually compare earnings in such an unusual year to a normal one, but here is are my main income sources in 2020 (left) and 2019 (right) side by side. As I explained, you can see while Glendon Studios and my cookbooks still make up a bulk of my income in both years, and as I mentioned freelance work has still been good and my affiliate income was unchanged, you can see very starkly here how sponsored content, that all important revenue stream was squeezed by the pandemic.

Introducing TaxScouts: my first time using an accountant.

What is TaxScouts

TaxScouts is a totally online service to help you complete your Self Assessment with a accredited accountant – every self employed person or someone who derives income from self employment (among other things) in the UK needs to fill out a self assessment. If you run a blog or an Instagram account that makes money, in almost all instances you’ll need to do one of these and while they’ve streamlined it a lot now, it can be very stressful depending on how complicated your business and finances are.

TaxScouts gifted me their self assessment service free for the 2020-21 tax year for review purposes.

TaxScouts asks you some basic questions about you and your business (why you need to fill out a self assessment, really) and then pairs you with an accountant who will ask you yet more questions, then go away and file your self assessment for you.

They also offer a tax advice call service and UTR (unique tax payer reference) registration, but I just used their self assessment service, which also came with a fair bit of tax advice while my accountant was figuring out how best to do my self assessment.

How did it work?

Signing up on the TaxScouts website was pretty easy, with clearly explained options (much more than on the HMRC site when you’re doing it yourself) to figure out what your self assessment needs to cover. You’ll need to already know how much you earned in that tax year – I love using Quickbooks to input all my earnings and scan in my receipts using their app which was really helpful as I had the number to hand, and I could simply present my accountant with a Quickbooks download afterwards. Then, all you have to do is upload identity documents to prove you are you and sign their terms of engagement.

Next, I was emailed by Jon, my accountant who had been allocated to me, and he walked me through getting him authorised as my account with HMRC, and then, aside from the odd question he emailed me about things like when I bought my car and how much I use it for my business, and the occasional document request, I pretty much left him too it.

Finally he had a tax return ready for me to view and approve I could access via my TaxScouts dashboard, and he sent me an email explaining it as well as the excellent news of the tax refund I was due! (Miracles do happen!)

It took about 5 months from Jon being assigned as my accountant for him to put together my return, but I need to disclose that sometimes he waited up to 2 weeks for me to reply to his emails holding up his work, and he did email a few times to apologise it was taking a while which was lovely of him because honestly, I was not fussed – I totally used to be that person who did the whole thing every January before the January 31st deadline!

What were my impressions?

Honestly, I’m really happy with the TaxScouts service – while yes, I probably could have managed this year doing my self assessment by myself as usual, it was nice to get some piece of mind that I’ve not been screwing it up all these years seeing an expert do it (something that might come back to bite me if I never suffer a tax enquiry), and some expert advice on things like putting some of the cost of my new kitchen – which is essentially my office – through my business. I’m not the most massively numerate person, and the streamlined online system was no fuss, worked with my schedule and did everything it could to take the stress away from my biggest business stress of the year. What I do is so new and unusual there are so many things not covered or thought about by the rules so I know in the past I have probably paid too much tax worried to claim things against tax in case I get in trouble and have to pay a fine in the future for getting it wrong by accident.

Would I use TaxScouts again?

Totally yes. I’ve never used an accountant before as it is such a big business expense, but knowing I’m paying a flat rate of £119 a year means that I for the first time had the reassurance that I was doing everything properly and the ability to ask all the questions I wanted, without the stress that it would massively eat into my profits.

I absolutely loved working with Jon as my accountant who was friendly, patient and knowledgeable and totally not what I thought having an accountant would be like. Literally my only pause point to if to pay my own money towards TaxScouts next year would be if I got to keep Jon or not, but yes I’ve confirmed at TaxScouts baring circumstances outside their control you use the same accountant every year unless you request otherwise.

If you fancy giving TaxScouts a go for the 2021-22 tax year, use this link to sign up and get 10% off (full disclosure, I’ll get a little something that I’ll put towards the cost of using them next year if you use my link).

So what is next for 2021?

Usually I finish off this post – ordinarily posted towards the start of the new year – with predictions for the year going forwards, but as we’re nearing the final quarter of it I feel a bit of a preview of blogging for profit in a post-pandemic world looks like:

Well, for one this spring I launched ingredient, my free newsletter with a paid subscription option over on Substack, asking people to pay for my recipes digitally for the first time (excepting eBook editions of my cookbooks, of course!) which I’ve been loving as a project so far, and which I hope will eventually grow enough to make up the shortfall in the years where I don’t have book advances to add to my income. On the other hand, Instagram’s constant algorithm changes have made things a bit dicey for making money over there, and I’ve noticed that there are less paid freelance commissions around as budgets are squeezed even tighter in the uncertain times ahead.

I hope you have all found this interesting, if not helpful! And again, thank you so, so much to TaxScouts for letting me test their service for free – honestly, if you’re self employed, especially if you do something totally digital and creative I’d recommend them. Do check out their website if you’ve got any more questions!

Discussion